When managing bank accounts, particularly your Charles Schwab brokerage account or checking account, it's crucial to keep a vigilant eye on your monthly fees. It's not uncommon to find unwanted recurring payments lurking in your account statement, which can be a result of forgotten subscription services. Left unnoticed, these subscriptions can pile up as monthly bills, leading to you inadvertently losing money.

The issue becomes particularly troublesome with multiple cards, such as the Charles Schwab Investor Credit Card or Charles Schwab Platinum Credit Card. However, worry not. In this article, we provide a comprehensive 10-step guide to cancel unwanted subscriptions directly from your Charles Schwab Bank App. We cover everything from how to locate these recurring payments on your debit card to cancelling them and preventing future charges.

Stay tuned as we unravel the process of freeing up your finances and taking control of your subscription services.

Finding and canceling subscriptions on your Charles Schwab cards shouldn't be hard

Finding and canceling subscriptions on your Charles Schwab cards shouldn't be hard10-steps to cancel via the mobile app

You can view transactions on the app just not an official statement.

- Login to your Charles Schwab Bank App

- Press on the account that you want to view

- Once you press this button, it goes straight to transactions: review the transaction history

- There is an option to view time range so you can put a date range for a month at the top

- Review statements line-by-line to find unwanted recurring payments (be sure you are checking the right months)

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Charles Schwab card (e.g., Charles Schwab Investor Credit Card and Charles Schwab Platinum Credit Card) you have in your wallet.

- Review your account regularly

10-steps to cancel via the Charles Schwab website

- Login via https://client.schwab.com/Login/

- Click on History under Accounts on the menu at the top

- Select the credit card (or another Charles Schwab account) in the drop-down box that you want to view for recurring payments

- Click on the Calendar icon to select the date range you want to view

- Click Search

- Review transaction line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-9 for every single Charles Schwab card (e.g., Charles Schwab Investor Credit Card and Charles Schwab Platinum Credit Card) you have in your wallet.

- Review your account regularly

It's crucial to go beyond an annual review of your credit card statements, opting instead for at least two thorough checks per year, spaced out for optimal timing. This practice is vital because we often sign up for new subscriptions throughout the year, attracted by their low costs, which seem insignificant in isolation. However, these small charges can accumulate stealthily, creating a significant impact on your overall financial picture. By reviewing your statements semi-annually, you're more likely to spot these recurring charges and evaluate their ongoing necessity, ensuring you're only paying for what you truly need and use.

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

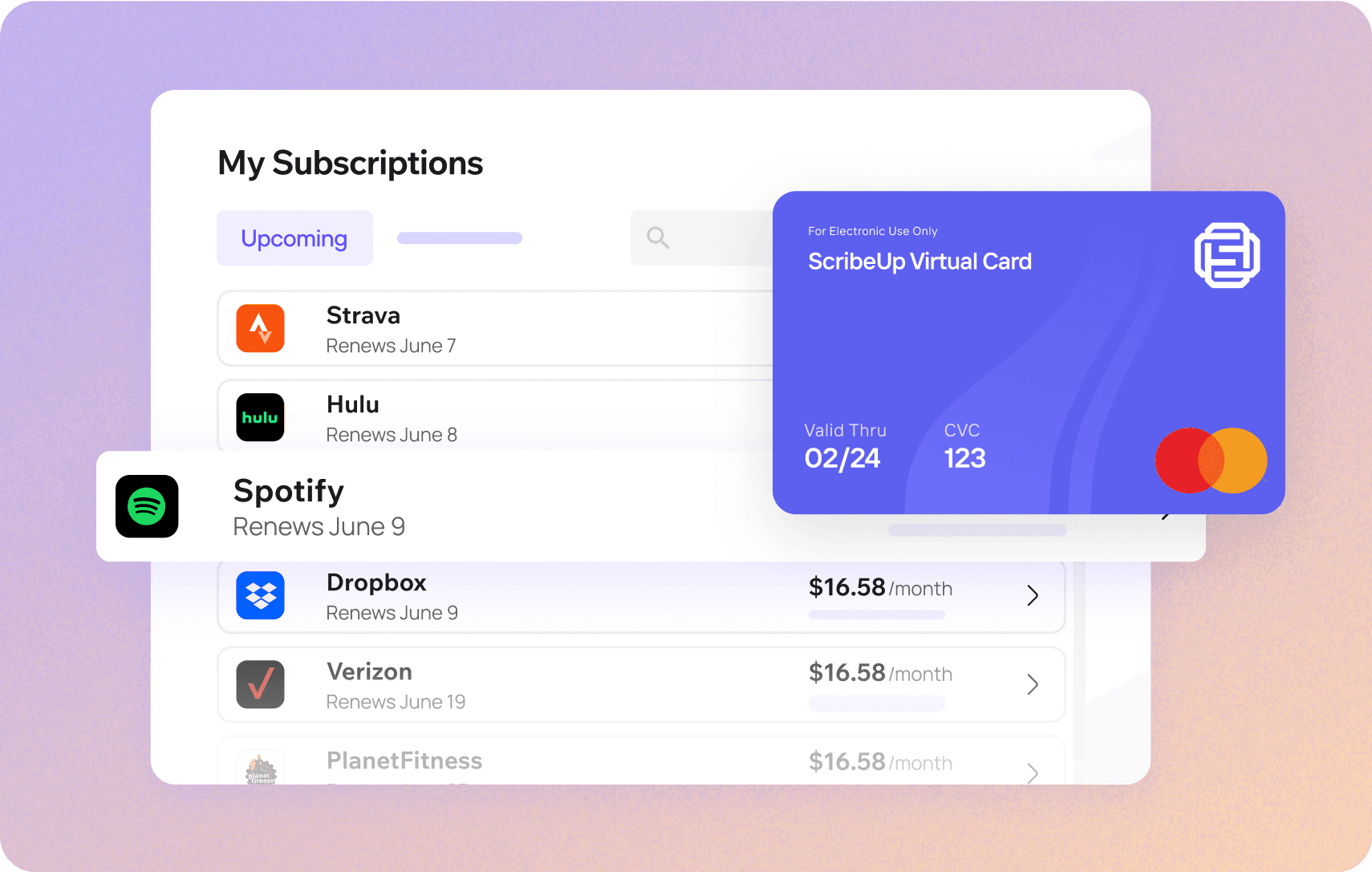

With ScribeUp, managing subscriptions on your Charles Schwab card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Charles Schwab cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Charles Schwab Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.