Are you tired of being charged for subscriptions you no longer use? Or maybe you just want to have a better understanding of where your money is going each month?

Luckily, there’s a way to find and manage your subscriptions on your Citi cards. In this guide, we'll walk you through the steps to find and view your recurring payments and subscriptions on your Citi card in three ways: mobile app, website, and ScribeUp.

How to Find Subscriptions with Citibank (credit card issuer) Effortlessly

How to Find Subscriptions with Citibank (credit card issuer) EffortlesslyTwo ways to identify your digital subscriptions on your Citibank cards

Whether it’s your Citi Premier, Citi Custom Cash, or Citi Diamond Preferred, checking to see what subscriptions you are paying for isn’t difficult.

The problem is that it is entirely time-consuming. Below are the steps to find your monthly subscriptions on your Citi Card manually.

11 Steps to Find Recurring Payment on the Citi Mobile App

- Login to your Citi Mobile App

- Click Account Summary

- Click on Citi Card you want to review (e.g., Citi Double Cash Card, Citi Premier Card, Citi Secured Mastercard, Citi Simplicity Card)

- Review your credit and debit card transactions

- Click on Filter Transactions to specify a time period for your statement – we suggest at least 2 years to find yearly subscriptions too

- Once you specify the time period click on Apply to get a full view of your statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- If the recurring credit card charges are there and they are wrong you then have to go through the process of canceling.

Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription services manually. - Repeat steps 1-9 for every single Citi card (e.g., Citi Double Cash Card, Citi Premier Card, Citi Secured Mastercard, Citi Simplicity Card) you have in your wallet.

- Review your credit card account regularly

11 Steps to Identify your subscriptions via Citibank.com

- Login via https://www.citi.com/

- Click View Account Summary on the menu bar on the left-hand-side

- Click Credit Cards

- Click the Citi Card you want to review (Note: you can also just look at it by the checking account level, if easier)

- Click on Select Period to filter a time period for your credit card statement – we suggest at least 2 years to find yearly subscriptions too

- Once you specify the time period click on Apply to get a full view of your credit card statements

- Review statements line-by-line to find unwanted recurring charges.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription service manually.

- Repeat steps 1-9 for every single Citi card (e.g., Citi Double Cash Card, Citi Premier Card, Citi Secured Mastercard, Citi Simplicity Card) you have in your wallet.

- Review your account regularly

For Citi Bank cardholders, a proactive approach to managing finances involves more than just an annual glance at your card statements. It's advisable to review your Citi Bank card statements biannually, choosing times that are spread throughout the year. This method is crucial in a world where we often add new subscriptions with small, seemingly insignificant costs. These charges, though minor, can stealthily accumulate on your Citi Bank card, leading to a noticeable impact over time. Periodic reviews, strategically spaced, allow you to keep a closer eye on these recurring expenses, ensuring that you're not inadvertently paying for services that have become redundant in your daily life.

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

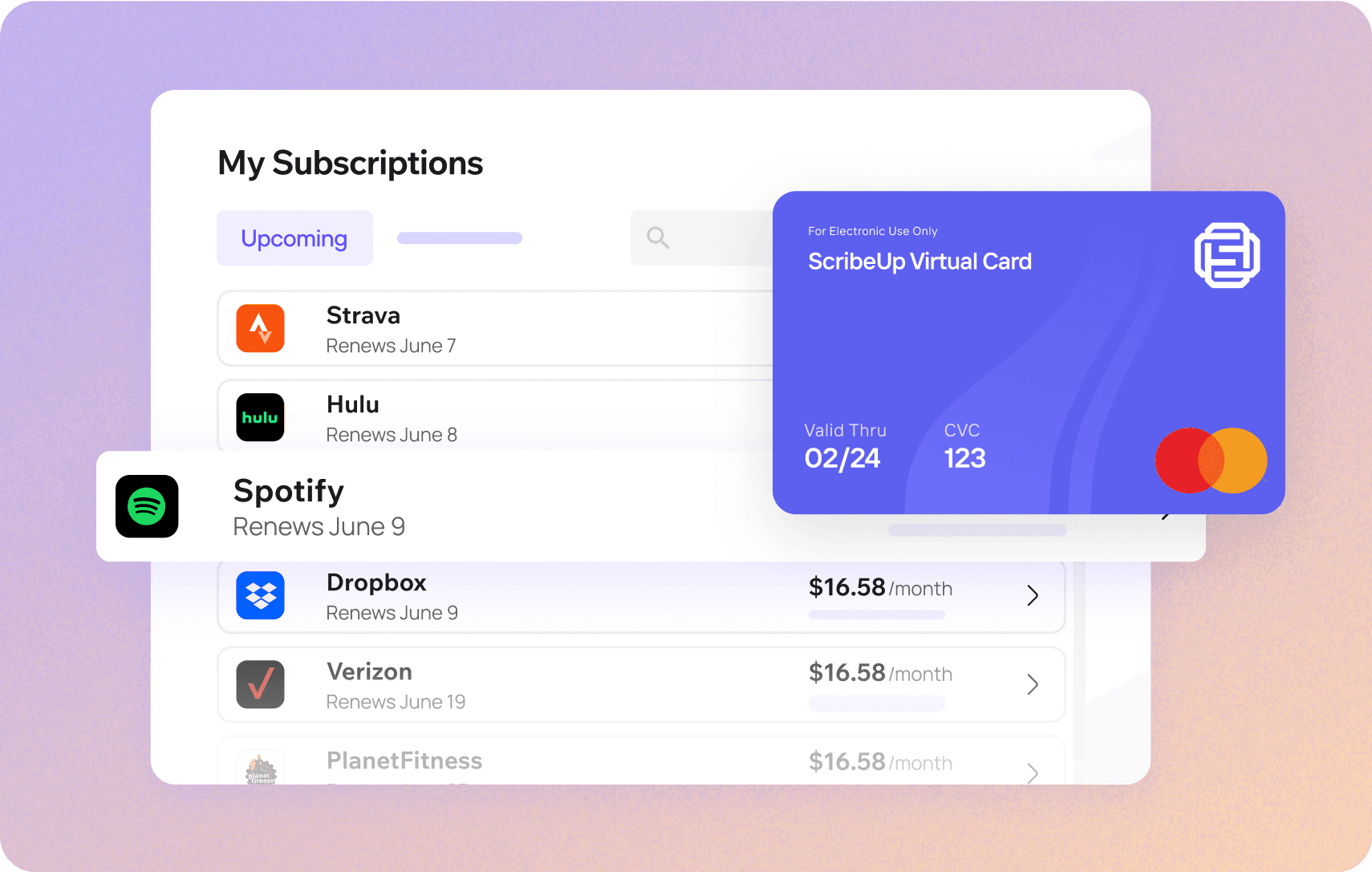

With ScribeUp, managing subscriptions on your Citibank card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Citibank cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Citibank cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.