With the abundance of subscription services, it can be challenging to keep track of monthly charges. This often leads to unwanted automatic payments going out of your account each month.

In this article, we'll show you how to take control of your finances and simplify your budget by cancelling these unwanted subscriptions on your Huntington Bank cards. Our step-by-step guide will make it easy to identify these services and stop automatic payments, giving you peace of mind and more control over your monthly spending. Say goodbye to unexpected charges and hello to a streamlined budget.

Huntington Bank makes it difficult to find all your subscriptions

Huntington Bank makes it difficult to find all your subscriptionsIronically, Huntington Bank has a feature called Bill Pay to create auto-payments for recurring subscriptions. This can make it challenging to stop an automatic payment that is draining your account.

If you have already identified the merchant and subscription, then you can see how many times you paid them by viewing payment history for the specific payee by going to the Payment History page under the Bill Pay tab. Choose the payee and date range you wish to see, then click "View Payee History." This is counter-intuitive considering you are trying to find the subscription service you are paying for – if you already know the service, you would just turn off Bill Pay!

Remember, the Fair Credit Billing Act provides certain protections when you deal with bank or credit union errors or unauthorized charges on your credit or debit card. You have the right to dispute and stop these charges, and Huntington Bank must comply.

11-steps to cancel subscription via mobile app

- Login to your Huntington Bank App

- In the Hub screen, Tap the Credit Card (or another Huntington Bank Account) that you want to find your recurring payments

- Tap View Statements

- Tap on the most recent year and month to find monthly statement

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-8 for every single Huntington Bank card (e.g., Huntington Voice Credit Card, Huntington Asterisk-Free Rewards Credit Card, Huntington 25 Rewards Credit Card. Huntington Secured Credit Card, Huntington Private Bank Credit Card) you have in your wallet.

- Review your account regularly

Regularly scrutinizing bank statements is crucial in today's subscription-heavy world. Often, latent subscriptions, especially those under $15, slip under the radar due to their seemingly insignificant individual cost. However, these small charges add up quickly. It's not uncommon for an average person to have at least 12 different subscriptions (and that was in 2020!), ranging from streaming services to app memberships. This oversight can lead to a substantial, often unnoticed, monthly financial drain. Keeping a vigilant eye on these statements and tallying up these subscriptions is essential to maintain control over personal finances.

11-steps to cancel subscription via website

- Login via https://www.huntington.com/

- Click Service Center

- Click View Statements under Statements

- Under Credit Accounts filter the credit card (or another Huntington Bank Account) that you want to find your recurring payments

- Click the most recent statement under Select Statement

- Review statement line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-9 for every single Huntington Bank card (e.g., Huntington Voice Credit Card, Huntington Asterisk-Free Rewards Credit Card, Huntington 25 Rewards Credit Card. Huntington Secured Credit Card, Huntington Private Bank Credit Card) you have in your wallet.

- Review your account regularly

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

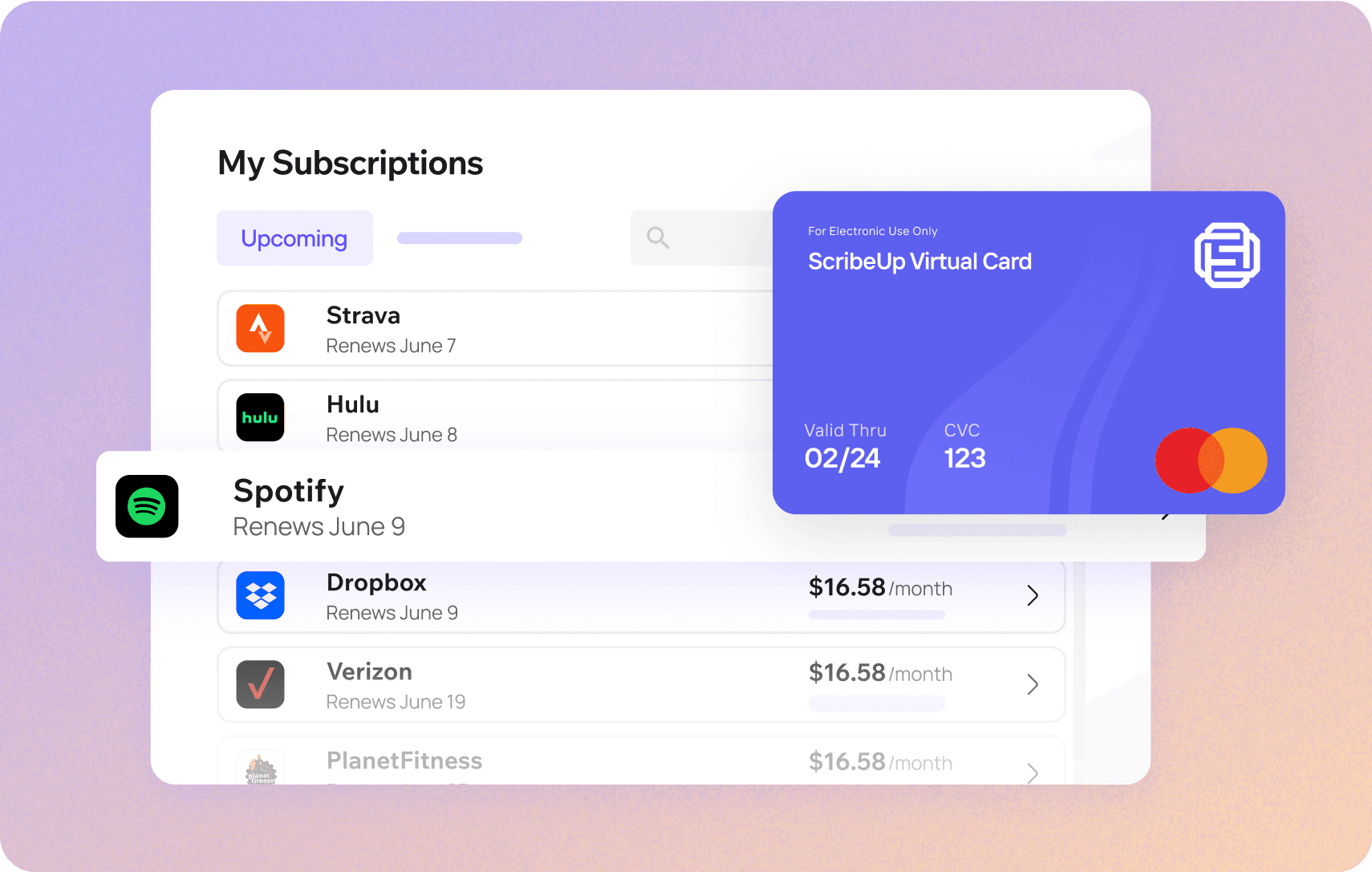

With ScribeUp, managing subscriptions on your Huntington Bank card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your Huntington Bank cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your Huntington Bank Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.