US Bank, known for its plethora of features, offers an invaluable tool for monitoring the merchants or billers authorized to charge your US Bank credit cards. With this feature, managing your spending becomes less of a chore. Whether you're accessing your account via a mobile app or online, we have provided the quickest way to utilize this feature.

However, bear in mind that this list of recurring payments is merely informative. It may not encompass all your recurring payments and charges applied to your credit or even your debit card. In a world where many services lure consumers with attractive free trials that inevitably turn into a recurring charge, it's essential to keep tabs on a transaction. This guide is here to help you in this endeavor.

Whether you need to identify an unwanted subscription service or request the cancellation of such services, we've got you covered. So, let's dive in and learn how to streamline your spending by effectively managing your subscriptions on US Bank cards.

US Bank Mobile App to help cancel unwanted recurring bills

US Bank Mobile App to help cancel unwanted recurring billsUsing the Auto-charge feature

Ironically, the US Bank has a feature called Recurring Charges to create auto-payments for recurring subscriptions. If you have already identified the merchant and subscription. This is not truly helpful when you are trying to see your subscriptions that you don’t know you have. However, if you already know the ones you want to cancel, we listed out the ways here:

7-steps via the US Bank Mobile App

- Login to your US Bank Mobile App

- Tap Customer Service

- Tap Self Service

- Tap View Recurring Charges or Merchants (in the Credit Cards, Charge Cards, and Personal Lines section)

- Review the list of your automatic charges

- Repeat steps 1-6 for every single US Bank card you have in your wallet.

- Review your account regularly

9-steps via the US Bank Website

- Login via https://onlinebanking.usbank.com/auth/login/

- Click Main Menu (upper left corner)

- Click Manage Cards

- Choose an account or credit card (e.g., U.S. Bank Cash+, U.S. Bank Shopper, U.S. Bank Altitude Go, U.S. Bank Altitude Connect, U.S. Bank Altitude Reserve, U.S. Bank Platinum Card) that you want to check your recurring payments

- Click View Recurring Charges or Merchants from the Credit Cards, Charge Cards, and Personal Lines

- Review the list of your automatic charges

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to check the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-7 for every single US Bank card you have in your wallet.

- Review your account regularly

Note: The list provided by US Bank only reflects activity from the last 18 months and is not all-inclusive, so we suggest you also do the manual way for proper security.

For US Bank card users, it's wise to go beyond the annual review of your card statements. We suggest inspecting your US Bank card statements at least twice each year, and ideally at different intervals. This practice is particularly important because throughout the year, we often sign up for new subscriptions, attracted by their seemingly low costs. However, these minor charges on your US Bank card can accumulate unnoticed, gradually impacting your financial situation. By conducting reviews at separate points in the year, you can better monitor these additions and ensure that you're not inadvertently accumulating unnecessary subscription costs. Regular scrutiny helps in maintaining a clearer and more controlled financial landscape.

Manually finding and cancelling unwanted bills

13-steps via the US Bank Mobile App

- Login to your US Bank Mobile App

- Tap Main Menu (upper-left corner)

- Tap Statements & docs

- Tap e-Staements

- Choose an account or credit card (e.g., U.S. Bank Cash+, U.S. Bank Shopper, U.S. Bank Altitude Go, U.S. Bank Altitude Connect, U.S. Bank Altitude Reserve, U.S. Bank Platinum Card) that you want to find your recurring payments

- Click the most recent month’s statement

- Click Download

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-11 for every single U.S. Bank card (e.g., U.S. Bank Cash+, U.S. Bank Shopper, U.S. Bank Altitude Go, U.S. Bank Altitude Connect, U.S. Bank Altitude Reserve, U.S. Bank Platinum Card) you have in your wallet.

- Review your account regularly

13-steps via usbank.com

- Login via https://onlinebanking.usbank.com/auth/login/

- Click My Accounts

- Click My documents

- Click Statements

- Click the account or credit card (e.g., U.S. Bank Cash+, U.S. Bank Shopper, U.S. Bank Altitude Go, U.S. Bank Altitude Connect, U.S. Bank Altitude Reserve, U.S. Bank Platinum Card) that you want to find your recurring payments

- Click the most recent month’s statement

- Click Download

- Review statements line-by-line to find unwanted recurring payments.

- Take note of the merchant name, amount, and next scheduled payment date for each recurring payment.

- Click previous month’s statement to ensure the monthly or yearly subscription charge is the same and wasn’t increased

- If the charge is there and it is wrong you then have to go through the process of canceling. Once you've identified a recurring payment you want to cancel, you'll need to find the merchant's contact information and go through the process of canceling that subscription manually.

- Repeat steps 1-11 for every single U.S. Bank card (e.g., e.g., U.S. Bank Cash+, U.S. Bank Shopper, U.S. Bank Altitude Go, U.S. Bank Altitude Connect, U.S. Bank Altitude Reserve, U.S. Bank Platinum Card) you have in your wallet.

- Review your account regularly

3 steps via : The Easiest Solution for Identifying & Canceling Subscriptions

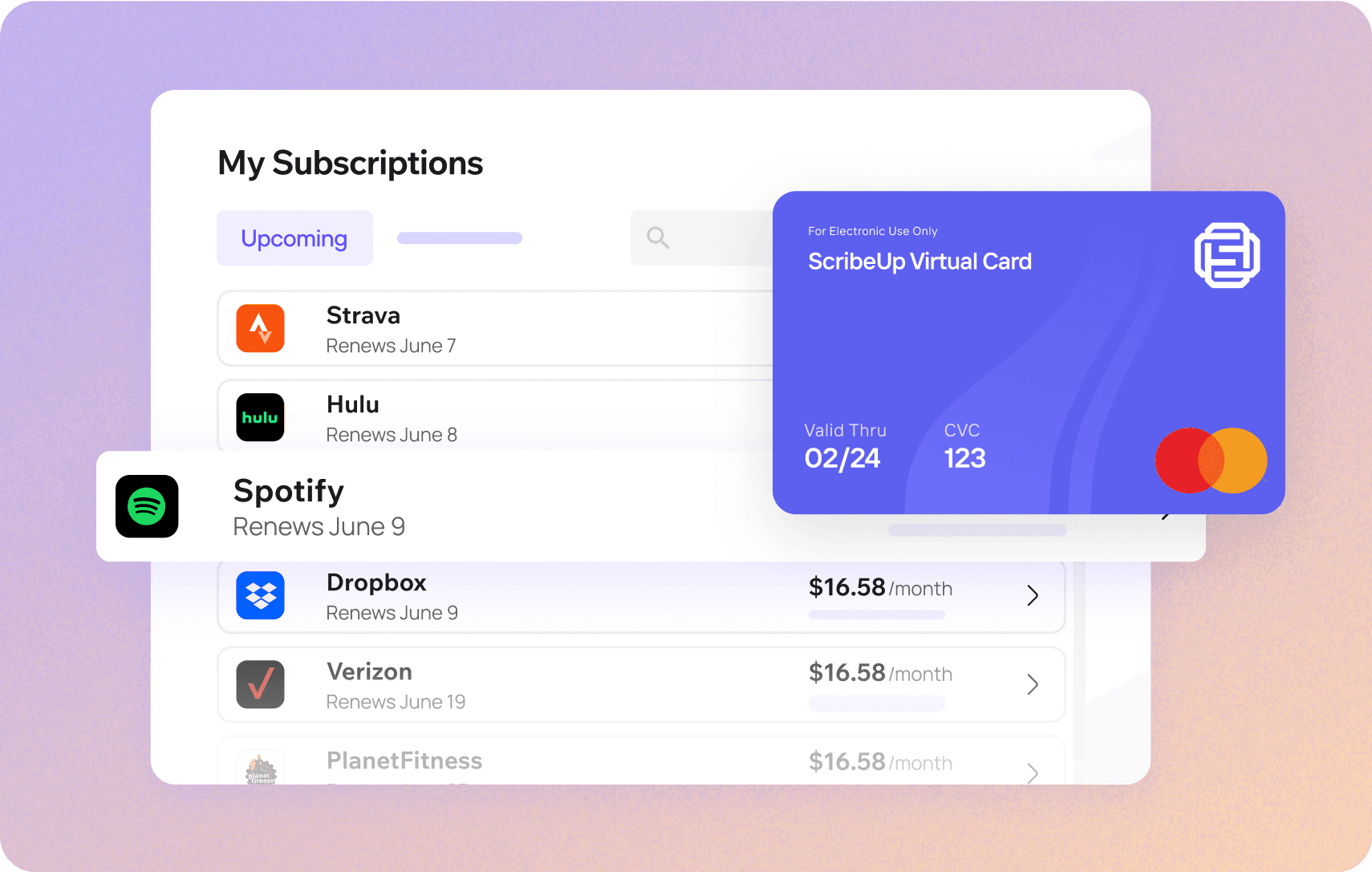

With ScribeUp, managing subscriptions on your US Bank card becomes a breeze. By finding and canceling unwanted subscriptions, you'll be able to focus on the subscriptions that truly matter to you — and with ScribeUp, it won’t waste your time!

Subscriptions are so much more enjoyable when they’re managed for you.

Subscriptions are so much more enjoyable when they’re managed for you.This all-in-one subscription manager simplifies the process of identifying unwanted subscriptions and canceling recurring payment.

By connecting your US Bank cards, you can easily find, cancel, or restart a service with just one click, saving you money and time:

- Scan your US Bank Cards on ScribeUp – ScribeUp show you a simple list of all of your active subscriptions on your cards (some of which you may not know you're paying for)

- Transfer your subscriptions to your FREE ScribeUp Subscription Card

- Once you do, you’ll get immediate access to features including 1-click cancellation, price-locks, and calendar reminders.

That’s it! So simple and completely FREE! Sign-up for ScribeUp to experience subscription power!

ScribeUp is completely free to use. There are no fees or hidden charges. You only pay for subscriptions you connect to your ScribeUp Card, and you can unsubscribe from any active subscription with a single click.